Keeping the financial ecosystem secure from money laundering, terrorist financing or other nefarious activities is. At the heart of these protective measures is the Customer Identification Program (CIP), a rule requiring financial institutions to obtain and verify identifying information on customers. In this article, we take a closer look at what CIP is, how it differs from Know Your Customer (KYC) protocols, those who need to adhere to it, the needs and procedures involved and what that means for businesses.

What is Customer Identification Program?

Customer Identification Program (CIP) are procedures a company must have in place the USA PATRIOT Act of 2001 requiring financial institutions to verify the identity of any person opening an account. The intention of CIP is to prevent financial crimes by knowing the customers / clients of institutions and minimizing, thus avoiding facilitating illegal activities. CIP enables financial institutions to identify and prevent dubious activities thereby ensuring the integrity of the financial system.

CIP vs. KYC

Although both CIP and KYC work towards the same goal of financial security, they each operate at a different front:

CIP (Customer Identification Program): A subset of the rules of regulation originally adopted under the USA PATRIOT Act, CIP focuses on identifying customers during interval account opening process. This includes basic data like name, date of birth, address and ID numbers.

Know Your Customer (KYC): KYC is actually a broader concept, which not only includes CIP but also the ongoing processes of businesses to understand their customers and their financial behaviors, as well as to assess their risk profiles.

KYC, or know your customer, is part of the customer due diligence (CDD) process that involves monitoring transactions and ensuring customers are acting within their expected profile.

Simply put, CIP is a subset of the larger KYC umbrella and is part of the first step of customer due diligence.

Who is Subject to the CIP Rule?

The CIP rule applies to a wide range of financial institutions operating within the United States, including:

Banks and Credit Unions: Traditional financial institutions that offer deposit accounts, loans, and other financial services.

Broker-Dealers: Entities involved in the buying and selling of securities.

Mutual Funds: Investment companies that pool funds from investors to purchase securities.

Futures Commission Merchants and Introducing Brokers: Firms dealing with futures contracts and commodity options.

Requirements of the Customer Identification Program

A compliant CIP must include the following elements:

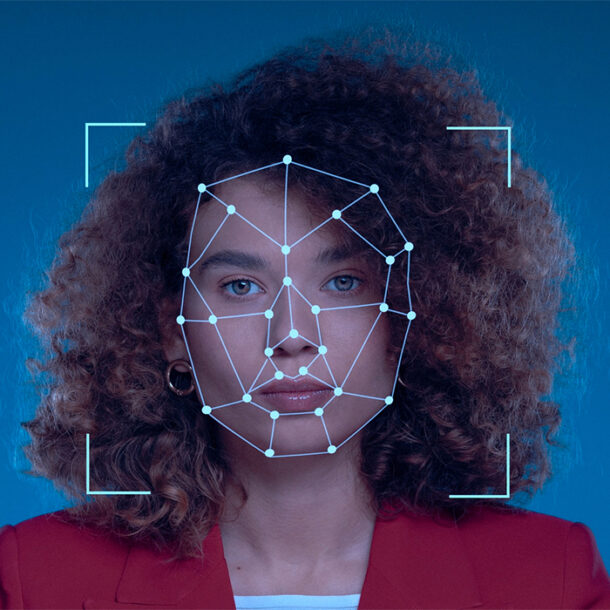

Identity Verification Procedures: Institutions must establish risk-based procedures to verify the identity of each customer. This involves collecting identifying information and utilizing documentary or non-documentary methods to confirm the information’s accuracy.

Record-Keeping: Financial institutions are required to maintain records of the information used to verify a customer’s identity. These records must be retained for a minimum of five years after the account is closed.

Comparison with Government Lists: Institutions must check customers’ identities against government lists of known or suspected terrorists or terrorist organizations to ensure they are not facilitating transactions with prohibited entities.

Customer Notice: Customers must be informed that the institution is requesting information to verify their identities. This notice can be provided verbally, in writing, or through a posted sign.

Customer Identification Procedure

The customer identification procedure involves several key steps:

Collection of Information: At the time of account opening, institutions must collect essential information, including the customer’s name, date of birth, address, and identification number (such as a Social Security Number or Taxpayer Identification Number).

Verification of Identity: Institutions must verify the collected information using:

Documentary Methods: Reviewing government-issued identification documents like passports or driver’s licenses.

Non-Documentary Methods: Utilizing external databases, credit reports, or other reliable sources to confirm identity.

Record Maintenance: Detailed records of the information collected, and the methods used for verification must be maintained, ensuring transparency and accountability.

Comparison with Government Lists: The customer’s information should be cross-referenced with government-issued lists to identify any potential matches with known or suspected terrorists.

Implementing these procedures enables institutions to establish a reasonable belief that they know the true identity of their customers, thereby reducing the risk of financial misconduct.

CIP and Know Your Business

For businesses operating within the financial sector, implementing a robust CIP is not only a regulatory requirement but also a critical component of risk management. A well-structured CIP can:

Enhance Security: By verifying customer identities, businesses can prevent unauthorized access and reduce the likelihood of fraud.

Build Trust: Customers are more likely to engage with institutions that prioritize security and compliance, fostering long-term relationships.

Ensure Compliance: Adhering to CIP requirements helps businesses avoid legal penalties and reputational damage associated with non-compliance.

Aspect | CIP (Customer Identification Program) | KYC (Know Your Customer) |

Definition | A legal requirement to verify the identity of customers when they open an account. | A broader process aimed at understanding customers’ financial behaviors and risk profiles. |

Objective | Focuses on identity verification to ensure the customer is who they claim to be. | Ensures financial institutions know their customers and can assess and mitigate associated risks. |

Scope | Limited to identity verification during account opening. | Encompasses CIP and includes ongoing customer due diligence (CDD) and transaction monitoring. |

Mandated By | USA PATRIOT Act of 2001. | Global anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. |

Key Components | Collecting customer names, date of birth, address, and identification number. | Includes CIP plus understanding the source of funds, monitoring transactions, and identifying unusual activities. |

Processes | Verification through documentary (e.g., government IDs) or non-documentary methods (e.g., external databases). | Periodic review of customer information, risk assessments, and transaction scrutiny. |

Timing | Conducted at the time of account opening. | Continuous process throughout the customer lifecycle. |

Record-Keeping | Focused on maintaining records of identity verification for at least five years. | Includes records of identity verification, due diligence, and monitoring activities. |

Applicability | Applies to financial institutions opening new accounts. | Applies to financial institutions and other businesses required to comply with AML/CTF laws. |

Focus on Risk Assessment | Does not assess the customer’s risk level. | Assesses the customer’s risk profile and monitors for suspicious activities. |

To effectively implement CIP, businesses should:

Develop Clear Policies: Establish comprehensive procedures for collecting and verifying customer information.

Train Staff: Ensure that employees are well-informed about CIP requirements and the importance of compliance.

Utilize Technology: Leverage advanced verification tools and software to streamline the identification process and maintain accurate records.

By integrating CIP into their operations, businesses can create a secure environment that deters financial crimes and promotes customer confidence.

In conclusion, the Customer Identification Program is a fundamental aspect of financial security, designed to verify customer identities and prevent illicit activities. Understanding the distinctions between CIP and KYC, recognizing the entities subject to CIP rules, and implementing the necessary procedures are essential steps for businesses to ensure compliance and protect the integrity of the financial system.

CIP, as a foundational component of the broader KYC framework, represents the first step in demonstrating due diligence toward customers. KYC processes, enhanced by advanced technologies such as generative AI, offer strategic advantages, particularly for businesses in the financial ecosystem. These technologies enable businesses to comply with regulations while providing seamless, fast and secure digital onboarding processes. EnQualify is revolutionizing KYC processes with AI-powered solutions that help financial institutions operate more efficiently and enhance the customer experience.

Industries

Company

Resources

Copyrights © EnQualify | All rights reserved. Privacy Policy | Cookie Policy | Terms of Use | Security & Compliance