In today’s fast-paced digital world, financial institutions and businesses require a secure, fast, and intelligent document verification process to onboard customers smoothly. Traditional OCR (Optical Character Recognition) solutions rely on manual selections and predefined formats, often leading to delays, errors, and poor user experience.

EnQualify’s OCR with AI Enhancement takes document verification to the next level by automatically detecting, extracting, and verifying identity documents with AI-powered accuracy. By utilizing OCR, MRZ (Machine Readable Zone) analysis, and mobile edge AI technology, EnQualify ensures seamless ID verification with unmatched speed and reliability.

With EnQualify’s AI-Enhanced OCR, financial institutions and businesses can accelerate onboarding, reduce errors, and provide frictionless verification experience—all while ensuring top-tier security.

EnQualify’s cutting-edge AI on mobile edge technology processes documents directly on the user’s device, reducing processing time and enhancing security. The system extracts key data fields (such as name, date of birth, document number) using advanced OCR and MRZ technology. The extracted data is validated against security algorithms to ensure authenticity and accuracy.

EnQualify thrive in the market with the several key features

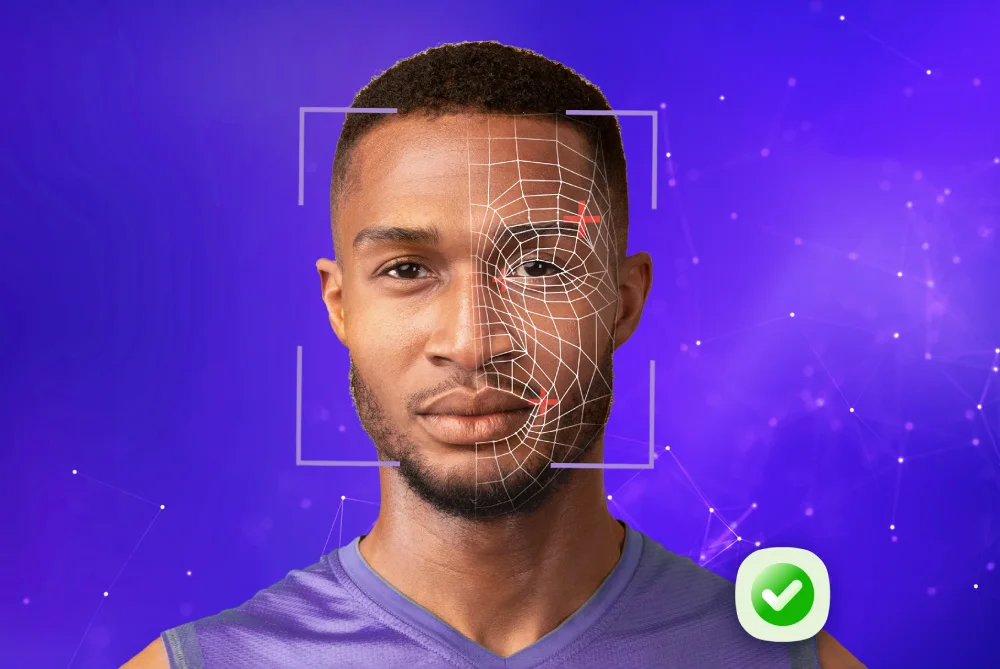

EnQualify’s face verification technology provides businesses with robust, efficient, and secure identity verification. It offers:

ID Verification is a crucial step in the KYC process, ensuring the verification of user identities. User information is extracted from ID cards through OCR and NFC technology, while the authenticity of the ID is validated. The extracted data is then cross-checked in real time to confirm identity validity and provide prevention of fraud risks.

Users capture a live selfie, which is compared against the ID card photo for facial matching. EnQualify’s AI-driven technology verifies identity by detecting and comparing key facial landmarks. EnQualify’s advanced verification solution enhances security and provide prevention of identity fraud.

Real-time AI verifies that the user is live by analyzing movements such as blinking, smiling, or turning the head. EnQualify’s anti-spoofing technology detects and blocks presentation attacks, including photos, videos, and deepfakes, ensuring secure authentication and compliance with global regulations.

In the final step of the KYC process, users are connected to a customer agent to finalize the verification. Thanks to EnQualify’s advanced technology, the customer agent can leverage AI to repeat the KYC steps and ensure security and accuracy. For countries where video calls are mandatory, this process is carried out in full regulatory compliance. Once verification is complete, users receive instant confirmation, and the data is securely stored within the customer’s compliance database.

In addition to KYC, EnQualify provides a suite of related solutions that enhance the customer verification process:

Industries

Company

Resources

Copyrights © EnQualify | All rights reserved. Privacy Policy | Cookie Policy | Terms of Use | Security & Compliance