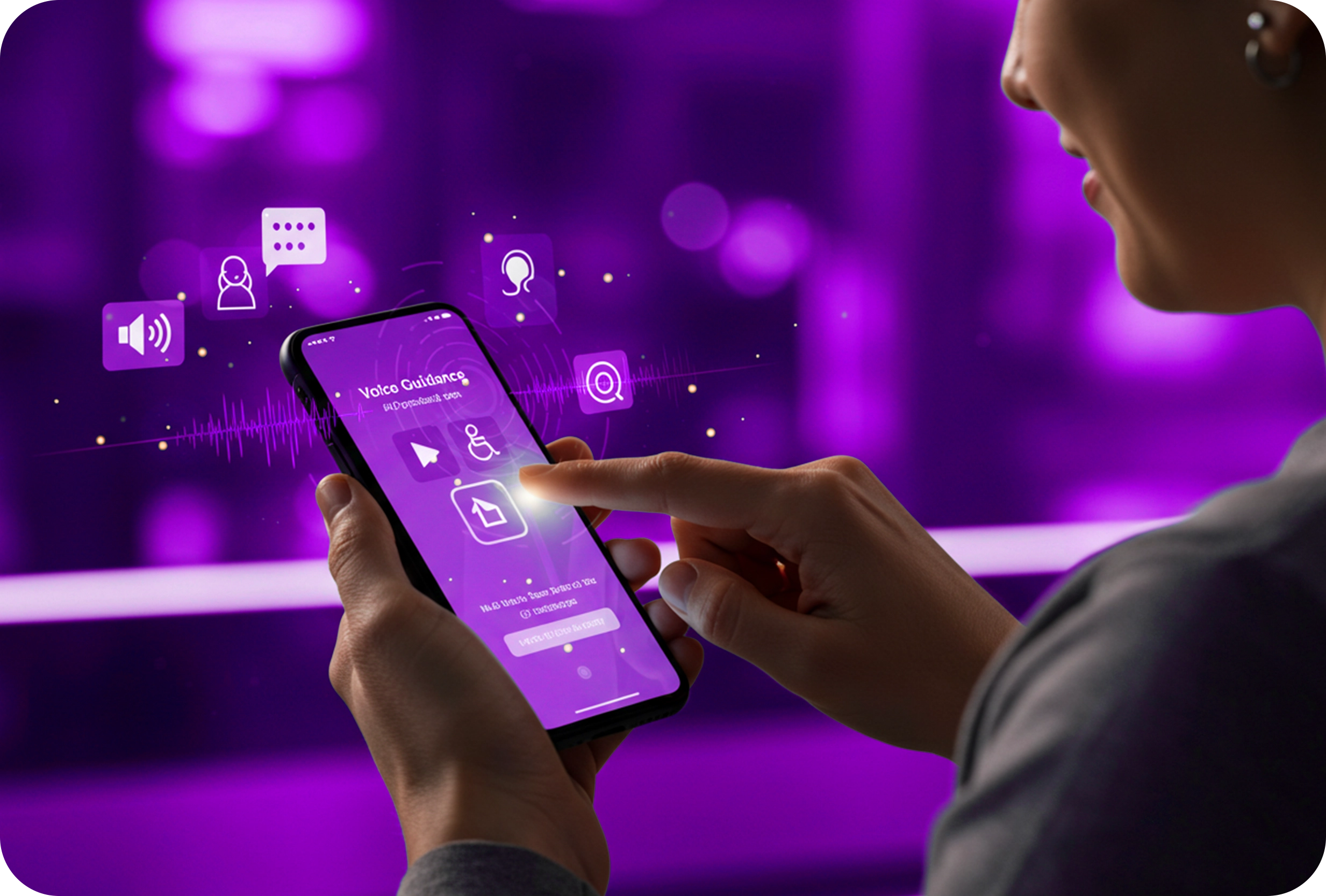

User verification processes must be both secure and seamless in all industries, especially in digital banking. However, many users struggle during identity verification steps, often leading to incomplete sessions and frustration. Voice Guidance is an innovative feature designed to enhance user experience and increase completion rates in verification flows.

How Voice Guidance Works

During key verification steps—such as liveness detection, face recognition, and ID verification—our Voice Guidance system provides real-time spoken instructions to ensure users complete the process accurately. For example, during liveness detection, the system might say, “Move your head slightly,” guiding users effortlessly through the steps.

EnQualify voice guidance provides seamless customer experiences with advanced features:

EnQualify stands out in the market for several key reasons:

With Voice Guidance, financial institutions can streamline the digital ID verification experience, ensuring a frictionless and user-friendly process for all customers.

Eliminates confusion and frustration during verification steps, increasing accessibility and user confidence. Speeds up the verification process and reduces wait times. It can also be customized to fit the institution’s branding and compliance needs.

The NFC Verification Solution by EnQualify lets several checks be performed to verify the identity document on all counts. Well, here are just some of the major verifications this solution supports:

Passport NFC verification: Authenticity verification of passports, which data is being read from an NFC chip embedded within the passport, matched to the standards of the issuing authority in question, and checks for tampering are done.

National ID card verification: This solution supports national ID cards on NFC technology, purposed to guarantee the correct and immediate verification of an individual’s identity.

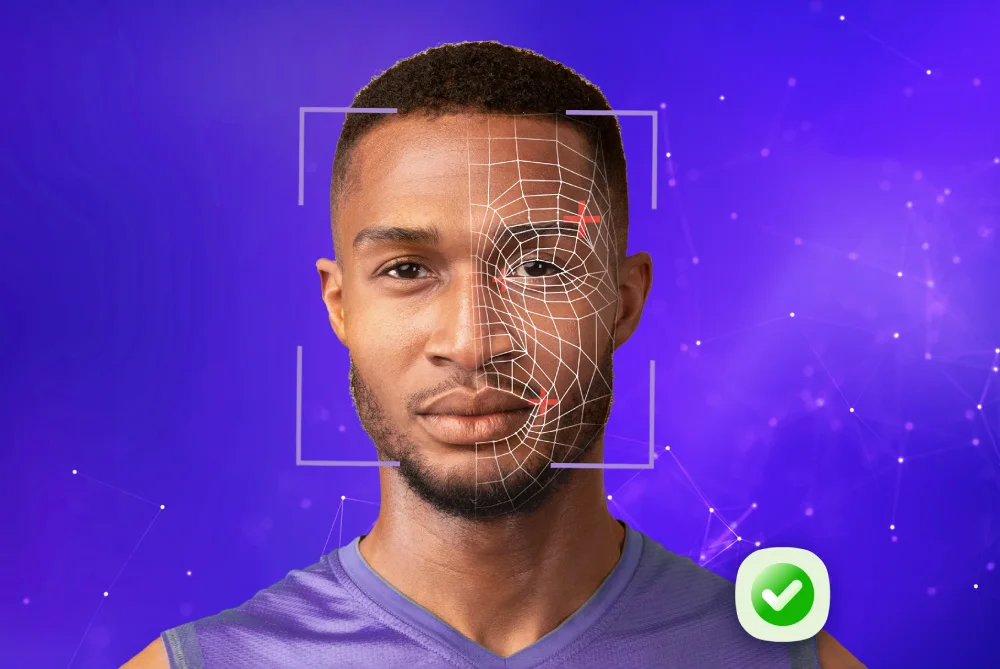

EnQualify’s face verification technology provides businesses with robust, efficient, and secure identity verification. It offers:

ID Verification is a crucial step in the KYC process, ensuring the verification of user identities. User information is extracted from ID cards through OCR and NFC technology, while the authenticity of the ID is validated. The extracted data is then cross-checked in real time to confirm identity validity and provide prevention of fraud risks.

Users capture a live selfie, which is compared against the ID card photo for facial matching. EnQualify’s AI-driven technology verifies identity by detecting and comparing key facial landmarks. EnQualify’s advanced verification solution enhances security and provide prevention of identity fraud.

Real-time AI verifies that the user is live by analyzing movements such as blinking, smiling, or turning the head. EnQualify’s anti-spoofing technology detects and blocks presentation attacks, including photos, videos, and deepfakes, ensuring secure authentication and compliance with global regulations.

In the final step of the KYC process, users are connected to a customer agent to finalize the verification. Thanks to EnQualify’s advanced technology, the customer agent can leverage AI to repeat the KYC steps and ensure security and accuracy. For countries where video calls are mandatory, this process is carried out in full regulatory compliance. Once verification is complete, users receive instant confirmation, and the data is securely stored within the customer’s compliance database.

In addition to KYC, EnQualify provides a suite of related solutions that enhance the customer verification process:

Industries

Company

Resources

Copyrights © EnQualify | All rights reserved. Privacy Policy | Cookie Policy | Terms of Use | Security & Compliance