The advancement of technology allowed for the creation of a face recognition system in which artificial intelligence is responsible for the recognition of faces. AI then matches them with a database after being captured in a digital picture or video frame respectively. There is a difference between what is known as facial recognition and what is known as face verification. Enqualify’s face verification is capable of matching faces shown in ID cards while as a next step, AI-assisted facial recognition uses real-time ID checks and employs methods to recognize facial gestures. But let’s look at how these processes work first.

The method of determining whether or not a person is who they claim to be by matching their face to a picture or video that has been preserved is known as face verification. Verifying a person’s identity using their face is not the same as performing facial recognition, which is recognizing a person from a big database of faces. The difference between face verification and face recognition is former is a one-to-one match, while the latter is a one-to-many match.

Face verification is crucial for several reasons, including:

Face verification technology provides a dependable and practical means of verifying an individual’s identification. It may be used in several situations, including opening bank accounts, unlocking devices, carrying out safe transactions, and confirming people’s identities when they register or enroll online. Organizations and companies can validate that the person doing transaction or registration is the same person on ID card.

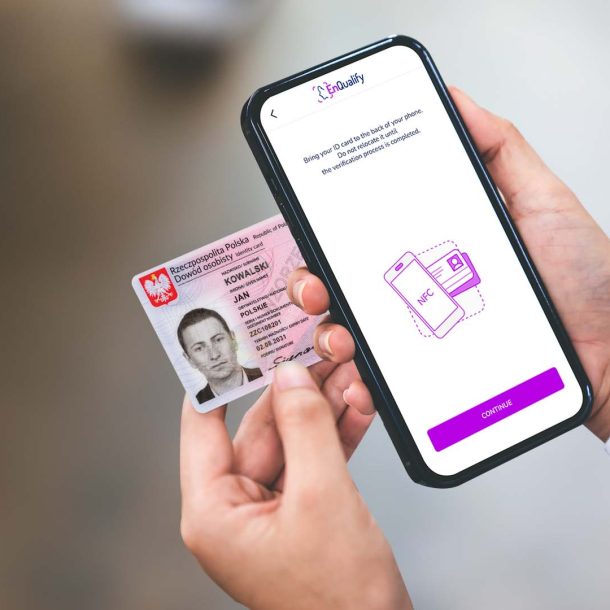

Through use of EnQualify’s facial recognition and verification, users take a picture of their ID card. The ID card’s face picture is then used for matching with current user selfie by NIST-certified artificial intelligence (AI) technology.

optional

Using your face to open doors, gadgets, or accounts may improve the security of both digital and physical access. Face verification technology validates identity of individuals captured by the camera, ensuring that they are indeed individuals they claim to be. This verification process safeguards against fraudulent activities and instances of identity theft.

Enqualify face verification protects users from password-related security breaches and businesses like e-commerce firms from CNP or chargeback frauds.

Yes, face verification aims to increase the security of overall processes; such as financial transactions or customer onboarding. But what about personal data and security of face verification process itself?

Because your personal information should be protected to the highest standard, Enqualify face verification is built on an identity management system based on blockchain technology and complete encryption. When identity verification is needed in this decentralized blockchain database, AI-powered matching algorithms compare face details with ID photos while making any intervention to process impossible.

Face verification may assist companies and institutions in adhering to laws and guidelines that demand identity verification.

For this aim, Enqualify’s face verification follows global rules and regulations, such as General Data Protection Regulation (GDPR), CCPA, Know Your Customer (KYC), eIDAS, and AML (Anti-Money Laundering). By guaranteeing that only those with permission may access a user’s or customer’s information, face verification can also assist in safeguarding their privacy and data.

Furthermore, considering this technology’s devotion to compliance&security, it can be and is currently used in business offices, government buildings, and airports to limit entry. It assists in preventing unwanted access by comparing a person’s face to a database of known people or recognizing possible dangers by comparing a face to watchlists.

Face verification technology may improve user experience in digital sphere by offering safe and easy ways to authenticate users by usually replacing passwords and easing the customer onboarding processes. Users may swiftly and securely access their devices, apps, or online accounts by just scanning their faces, which improves convenience and efficiency throughout the whole experience.

With Enqualify’s face verification included ID verification process, it becomes possible to finish your ID verification in only 5 seconds, and face matching in just 2.5 seconds, regardless of user volume or location thanks to AI on Mobile Edge technology.

Face verification can aid financial institutions and banks in verifying the identities of their customers, effectively mitigating risks associated with identity theft, money laundering, and fraudulent activities. Nowadays, many banks prefer online customer onboarding for opening new accounts and encouraging customers to perform their transactions via online means. This saves time for both sides, while banks and financial institutions can verify the ID info in seconds without physical presence in bank branches.

Face verification technology is critical in the fintech industry as it bolsters security measures by authenticating user identities during the authentication process, thereby mitigating the risks of unauthorized access and identity theft. Implementing streamlined and user-friendly authentication effectively reduces burden on users to remember intricate passwords. Furthermore, it ensures authorized account access and transaction initiation by comparing live images of users’ features with registered images, thereby aiding in preventing deception.

Face verification can assist healthcare providers in confirming patients’ identities and ensuring that the correct treatment, medication, or service is administered. Additionally, face verification enables patients to pay expenses, schedule appointments, and access their medical records with their appearance.

In this sector, face liveness verification can assist educators in verifying their students’ identities and ensuring that they attend classes, complete assignments, and sit for exams with integrity. Additionally, face verification enables students to access their courses, grades, and certificates using only their faces.

Face liveliness verification can be employed to authenticate the identity of a visitor and authorize their entry into a hotel room, fitness center, or any other establishment affiliated with hotel. In addition to aiding in crime prevention, facial recognition can be utilized to identify disruptive guests or visitors.

Enhancing consumer personalization stands as a conspicuous application of facial recognition technology within travel industry. By comparing images of features in physical surroundings to those stored in a database, hotels and other organizations can rapidly identify individuals and customize their service experiences.

Face verification technology is implemented in the retail and e-commerce sectors to augment consumer experience. This technology facilitates tailored offers, targeted advertising, and personalized recommendations by leveraging customer profiles and preferences. Additionally, it facilitates contactless payments and expedites the purchasing process.

Face verification technology is employed by government agencies to carry out various functions such as driver’s license issuance, identity verification, passport control, and public safety initiatives. It protects against identity deception and aids in securing access to government services.

Face verification requires the use of a device equipped with both a camera and an internet connection. Additionally, you must have a service or application that provides face verification as an option. Implementing face verification may require the following, although the specifics may differ by application or service:

Industries

Company

Resources

Copyrights © EnQualify | All rights reserved. Privacy Policy | Cookie Policy | Terms of Use | Security & Compliance